| 21 | |||||

| 21 | |||||

| 22 | |||||

| 22 | |||||

| 22 | |||||

| 22 | |||||

| 25 | |||||

| 26 | |||||

| 27 | |||||

| 27 | |||||

| 28 | |||||

| 28 | |||||

| 30 | |||||

| 30 | |||||

| 32 | |||||

| 32 | |||||

| 36 | |||||

| 39 | |||||

| 41 | |||||

| 42 | |||||

| 43 | |||||

| 45 | |||||

| 47 | |||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |||||

| 48 | |||||

| 50 | |||||

| 50 | |||||

| 51 | |||||

| 52 | |||||

| 53 | |||||

| 53 | |||||

| 55 | |||||

| 56 | |||||

| 56 | |||||

| 57 | |||||

| 57 | |||||

| 58 |

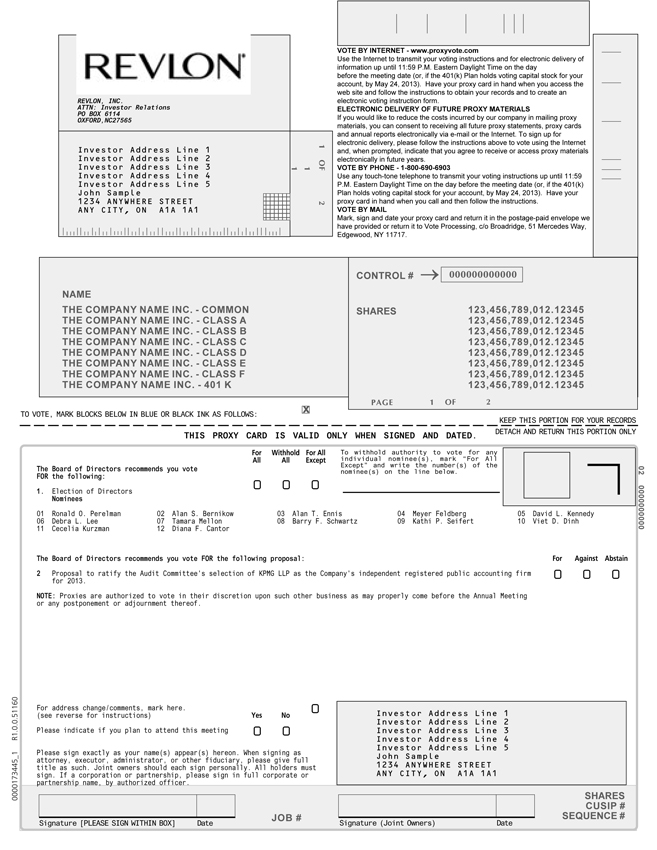

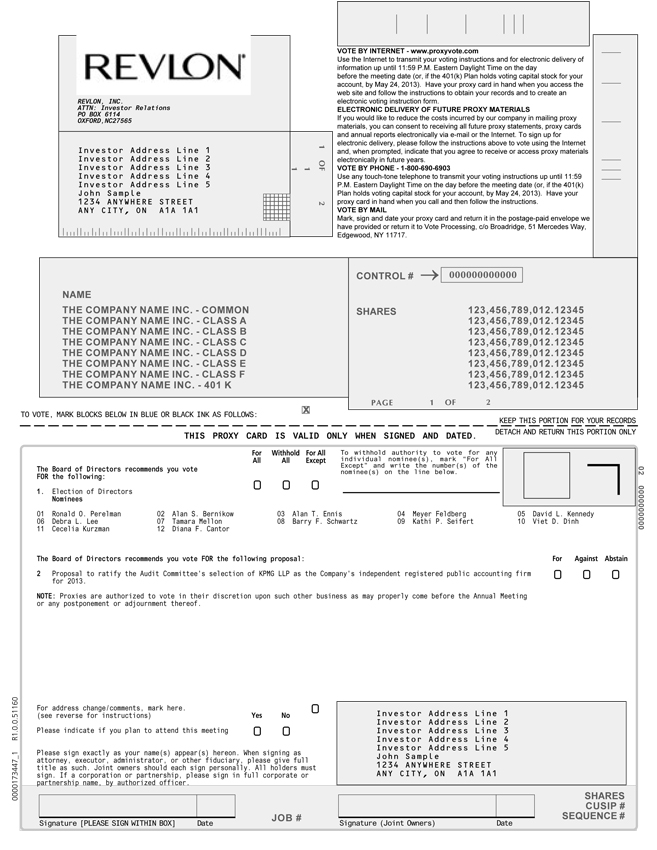

PROPOSAL NO. 2 — RATIFICATION OF AUDIT COMMITTEE’S SELECTION OF KPMG LLP | ||||

Vote Required and Board of Directors’ Recommendation (Proposal No. 2) | 59 | |||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| Annex A-1 | ||||

| Annex B-1 |

This summary highlights information contained elsewhere in this Proxy Statement. The following description is only a summary; for more information, you should carefully read and consider the entire Proxy Statement, as well as the Company’s 2012 Annual Report, before voting on the matters presented in this Proxy Statement.

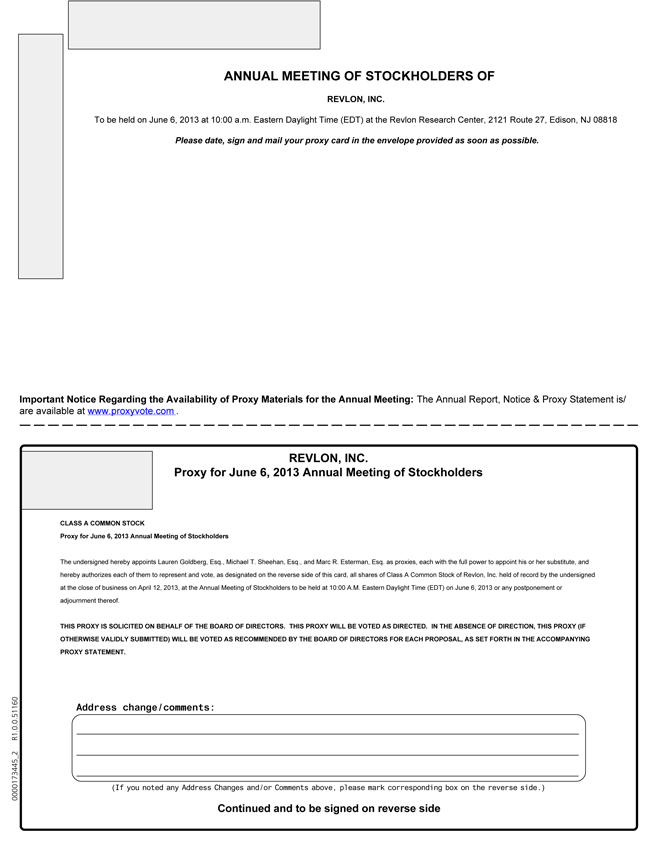

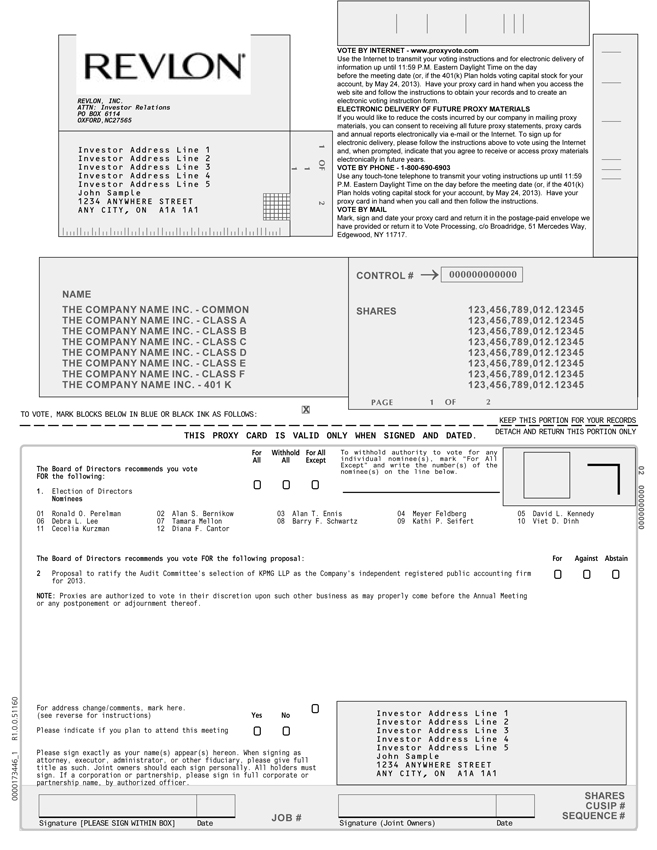

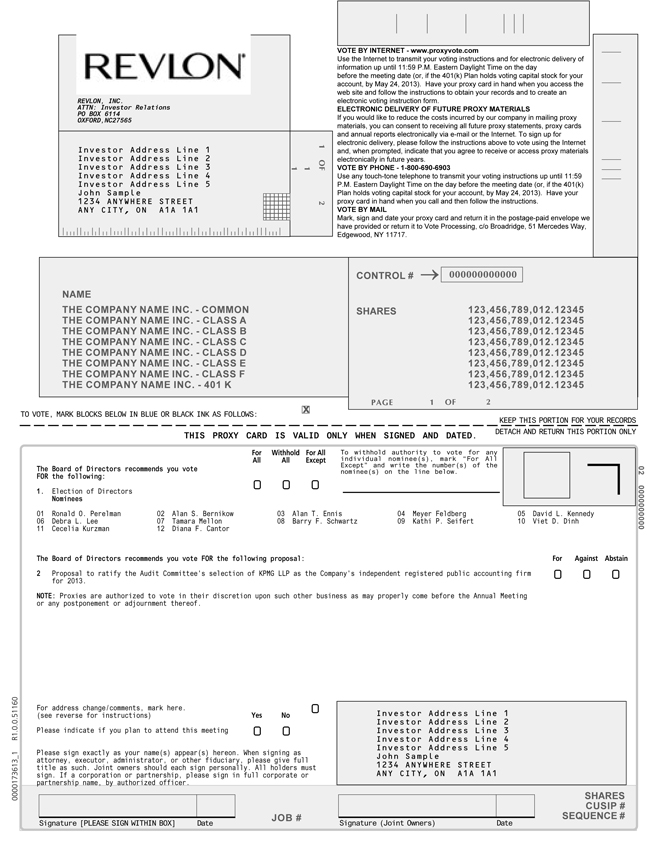

| 2013 Annual Meeting of Stockholders | ||

Time & Date | 10:00 a.m., June 6, 2013 | |

Place | Revlon Research Center 2121 Route 27 Edison, NJ 08818 | |

Record Date | April 12, 2013 | |

Voting | Each share of the Company’s Class A Common Stock and Series A Preferred Stock is entitled to one vote, and each share of the Company’s Class B Common Stock is entitled to ten votes. | |

Admission | Stockholders of record on the Record Date may attend the 2013 Annual Meeting upon presentation of appropriate admission materials; pre-registration is encouraged; see the “Questions and Answers About the Annual Meeting and Voting” section of this Proxy Statement for more information. | |

Meeting Agenda | 1. Election of Directors. 2. Ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2013. 3. Transact such other business that may properly be brought before the meeting. | |

| Voting Matters | ||

| Item | Board Vote Recommendation | |

1. Election of Directors | For each Director nominee. | |

2. Ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2013 | For. | |

Board Nominees

The following table provides summary information about each Director nominee. Each Director nominee is a current standing Director of the Company (other than Ms. Cantor, who is a new nominee). Each Director is elected annually by a plurality of votes cast.

| Name | Revlon Director Since | Independent | Committee Memberships | Committee Chairman | ||||

Ronald O. Perelman (Chairman) | 1992 | |||||||

Alan S. Bernikow | 2003 | X | Audit; Compensation | Audit; Compensation | |||||

Diana F. Cantor | — | X | |||||||

Viet D. Dinh | 2012 | X | Nominating & Corporate Governance | ||||||

Alan T. Ennis | 2009 | ||||||||

Meyer Feldberg | 1997 | X | Audit; Nominating & | Nominating & Corporate Governance | |||||

David L. Kennedy | 2006 | ||||||||

Cecelia Kurzman | 2013 | X | |||||||

Debra L. Lee | 2006 | X | Nominating & Corporate Governance | ||||||

Tamara Mellon | 2008 | X | |||||||

Barry F. Schwartz | 2007 | Compensation | |||||||

Kathi P. Seifert | 2006 | X | Audit; Compensation | ||||||

Auditors

As a matter of good corporate practice, the Company is asking its stockholders to ratify the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2013. Set forth below is a summary of information with respect to KPMG LLP’s fees for services provided in 2012 and 2011 (dollars are in millions).

Types of Fees | 2012 | 2011 | ||||||

Audit Fees | $ | 3.9 | $ | 3.8 | ||||

Audit-Related Fees | 0.2 | 0.2 | ||||||

Tax Fees | 0.2 | 0.2 | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

TOTAL FEES | $ | 4.3 | $ | 4.2 | ||||

|

|

|

| |||||

S-ii

| Q. | |

| Why am I receiving these proxy materials? | |

| A. | Our Board of Directors is providing this Proxy Statement and other materials to you in connection with the Company’s |

| Q. | Why did I receive a notice regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials? |

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at our 20112013 Annual Meeting, we are making the proxy materials and our 20102012 Annual Report available to our stockholders electronically via the Internet. On or about April 19, 2011,25, 2013, we are sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”). The Internet Notice contains instructions on how stockholders may access and review our proxy materials and our 20102012 Annual Report over the Internet and vote electronically, as well as instructions on how stockholders can receiverequest a paper copy of our proxy materials, including the 20112013 Proxy Statement, the 20102012 Annual Report and a form of proxy card. Otherwise, you will not receive a printed copy of the proxy materials (unless you already had a request for paper copies on file with our transfer agent or your broker). Instead, the Internet Notice will instruct you as to how you may access and review the proxy materials and submit your vote via the Internet. If you would like to receive a printed copy of the proxy materials, please follow the instructions included in the Internet Notice for requesting printed materials.

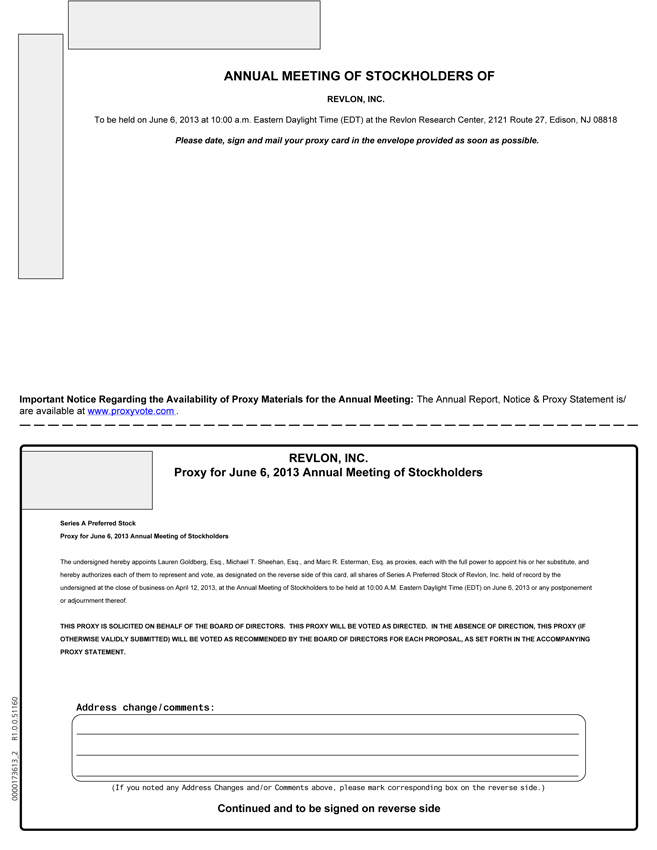

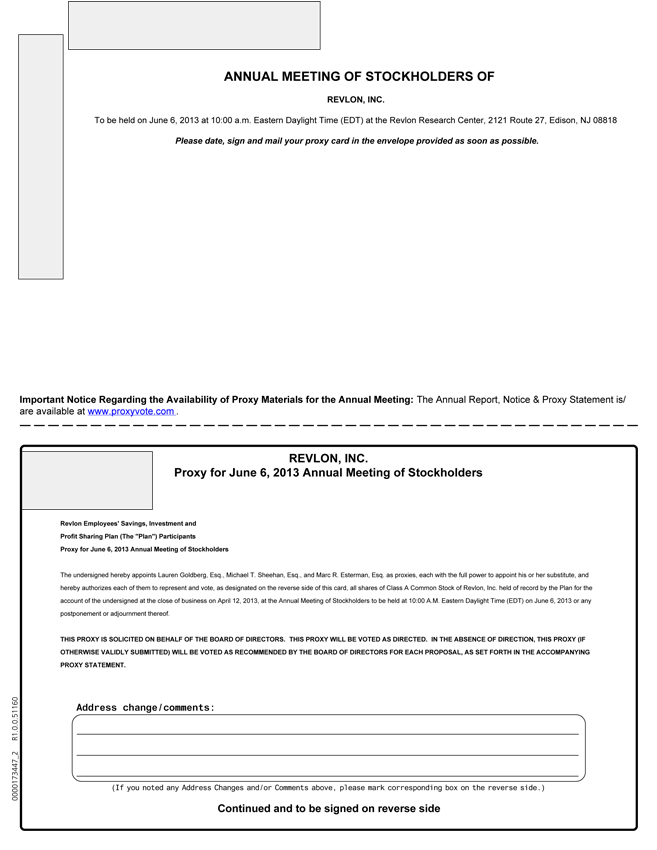

Important Notice Regarding the Availability of Proxy Materials for the June 2, 20116, 2013 Annual

Stockholders’ Meeting:

Our 20112013 Proxy Statement, including the Notice of Annual Meeting of Stockholders, and 20102012 Annual Report to Stockholders are available atwww.proxyvote.com (where stockholders may also vote their shares, via the Internet) and atwww.revloninc.com..

| Q. | |

| How can I request paper copies of proxy materials? | |

| A. | |

| Q. | When and where is the |

| A. | The |

i

| Q. | |

| What is the purpose of the | |

| A. | At the |

the election of the following persons as members of the Company’s Board of Directors to serve until the next annual stockholders’ meeting and until such directors’ successors are elected and shall have

been qualified: Ronald O. Perelman, Alan S. Bernikow, | ||

the ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2013; and

the transaction of such other business as may properly come before the 2013 Annual Meeting.

| Q. | |

| What are the voting recommendations of the Board? | |

| A. | The Board recommends the following votes: |

FOR each of the director nominees; and

FORthe ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2013.

| Q. | ||

| What is the difference between holding shares as a stockholder of record and as a beneficial owner? | |

| A. | Many holders of the Company’s voting capital stock hold such shares through a broker or other nominee (i.e., a beneficial owner) rather than directly in their own name (i.e., a stockholder of record). As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholder of Record. If your shares are registered in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, as of 5:00 p.m., Eastern Time, on the April 12, 2013 record date, you are considered the stockholder of record with respect to those shares, and these proxy materials are being made available, electronically or otherwise, directly to you by the Company. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or a third party, or to vote in person at the 2013 Annual Meeting. The Company has made available a proxy card or electronic voting means for you to use for voting purposes.

Reverse Stock Split. As previously disclosed, in September 2008, the Company effected a | ||

Beneficial Owner. If your shares are held in a brokerage account or by another nominee as of 5:00 p.m., Eastern Time, on the April 12, 2013 record date, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being made available, electronically or otherwise, by the Company to your broker, nominee or trustee and they should forward these materials to you, together with a voting instruction form if furnished via paper copy to your broker, trustee or nominee. |

ii

ii

| Q. | ||

| How do I vote? | |

| A. | You may vote using one of the following methods: |

Internet. For all holders of our voting capital stock (whether a stockholder of record or a beneficial owner), to vote through the Internet, log on to the Internet and go towww.proxyvote.com and follow the steps on the secure website (have your Internet Notice or your proxy card available as you will need to reference your assigned Control Number(s)). You may vote on the Internet up until 11:59 p.m. Eastern Time on June 1, 2010,5, 2013, which is the dateday before the June 2, 20116, 2013 Annual Meeting. If you vote by the Internet, you need not return your proxy card (if you received one), unless you wish to change your Internet vote.

Telephone. You may vote by telephone by calling the toll-free number on your proxy card up until 11:59 p.m., Eastern Time, on June 1, 2010,5, 2013, which is the dateday before the June 2, 20116, 2013 Annual Meeting, and following the pre-recorded instructions (have your Internet Notice or your proxy card available when you call as you will need to reference your assigned Control Number(s)). If you vote by telephone, you should not return your proxy card (if you received one), unless you wish to change your Internettelephone vote.

Mail. If you received your proxy materials by mail, due to having a request for paper copies on file with our transfer agent or your broker, you may vote by mail by appropriately marking your proxy card, dating and signing it, and returning it in the postage-prepaid envelope provided, or to Vote Processing (Revlon),c/o Broadridge, 51 Mercedes Way, Edgewood, NJ 11717, for receipt prior to the closing of the voting polls for the June 2, 20116, 2013 Annual Meeting.

In Person.Person. You may vote your shares in person by attending the 20112013 Annual Meeting and submitting a valid proxy at the 20112013 Annual Meeting. If you are a “registered owner” or “record holder” (i.e., you are listed as a stockholder on the books and records of our transfer agent), you may vote in person by submitting your previously furnished proxy or casting a voting capital stock ballot furnished by the Company at the Meeting prior to the closing of the polls; if you are a “beneficial owner” (i.e., your shares are held by a nominee, such as a bank or broker or in “street name”), you may not vote your shares in person at the 20112013 Annual Meeting unless you obtain and present to the Company an original (copies will not be accepted) legal proxy from your bank or broker authorizing you to vote the shares (“Requests for Admission” will not be accepted).

Voting, Generally.Generally. All shares that have been voted properly by an unrevoked proxy will be voted at the 20112013 Annual Meeting in accordance with your instructions. In relation to how your proxy will be voted, see “How will my proxy be voted?” below.

If you are a “beneficial owner” because your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are held in “street name”),you will receive instructions on how to vote from your bank, broker or other record holder. You must follow these instructions in order for your shares to be voted. You should instruct your nominee on how to vote your shares. Your broker is required to vote those shares in accordance with your instructions. If you do not give instructions to your broker, the broker may vote your shares only with respect to Proposal No. 2 (the ratification of the appointmentAudit Committee’s selection of the Company’s independent registered public accounting firm), which is considered a “routine” matter, and not with respect to Proposal Nos.No. 1 3 and 4.

| Q. | |

| Who can vote? | |

| A. | Only stockholders of record of Revlon, Inc. Class A and Class B Common Stock and Revlon, Inc. Series A Preferred Stock at 5:00 p.m., Eastern Time, on April |

iii

| those who have been granted and present an original, signed, valid legal proxy in appropriate form from a holder of record of Revlon, Inc. Class A or Class B Common Stock or Revlon, Inc. Series A Preferred Stock as of 5:00 p.m., Eastern Time, on April |

iii

As noted above, the Company has determined that stockholders who have not yet surrendered their old shares of Class A Common Stock to the Company’s transfer agent for exchange in connection with the Reverse Stock Split will be considered stockholders of record and will be permitted to receive these proxy materials, vote their shares (after giving effect to the1-for-10 Reverse Stock Split) and attend the 20112013 Annual Meeting.

| Q. | |

| How will my proxy be voted? | |

| A. | Your proxy, when properly submitted to us, and not revoked, will be voted in accordance with your instructions. If you sign and return your proxy card without indicating how you would like your shares to be voted, the persons designated by the Company as proxies will vote in accordance with the recommendations of the Board of Directors on Proposal No. 1 (the election of directors) |

Although we are not aware of any other matter that may be properly presented at the 20112013 Annual Meeting, if any other matter is properly presented, the persons designated by the Company as proxies may vote on such matters in their discretion.

| Q. | |

| Can I change or revoke my vote? | |

| A. | Yes. If you are a stockholder of record, you can change or revoke your vote at any time before it is voted at the |

executing and delivering a proxy bearing a later date, which must be received by the Company’s Secretary at 237 Park Avenue, 14th Floor, New York, NY 10017, Attention: Michael T. Sheehan, before the original proxy is voted at the 2013 Annual Meeting;

filing a written revocation or written notice of change, as the case may be, which must be received by the Company’s Secretary at 237 Park Avenue, 14th Floor, New York, NY 10017, Attention: Michael T. Sheehan, before the original proxy is voted at the 2013 Annual Meeting; or

attending the 2013 Annual Meeting and voting in person.

If you are a beneficial owner, please follow the voting instructions sent to you by your broker, trustee or nominee to change or revoke your vote.

To revoke a vote previously submitted electronically through the Internet or by telephone, you may simply vote again at a later date, using the same procedures, in which case the later submitted vote will be recorded and the earlier vote revoked.

| Q. | |

| What if I am a participant in the Revlon 401(k) Plan? | |

| A. | This Proxy Statement is being furnished to you if Revlon, Inc. Class A Common Stock is allocated to your account within the Revlon Employees’ Savings, Investment and Profit Sharing Plan (the “401(k) Plan”). The trustee of the 401(k) Plan, as the record holder of the Company’s shares held in the 401(k) Plan, will vote the |

iv

| shares allocated to your account under the 401(k) Plan in accordance with your instructions. If the trustee of the 401(k) Plan does not otherwise receive voting instructions for shares allocated to your 401(k) Plan Account, the trustee, in accordance with the 401(k) Plan trust agreement, will vote any such shares in the same proportion as it votes those shares allocated to 401(k) Plan participants’ accounts for which voting instructions were received by the trustee.401(k) Plan participants must submit their voting instructions to the trustee of our 401(k) Plan in accordance with the instructions included with the proxy card or Internet Notice so that they are received by 11:59 p.m. Eastern Time on May |

iv

| Q. | |

| Who can attend the | |

| A. | Anyone who was a stockholder of the Company as of 5:00 p.m., Eastern Time, on April |

To attend the 20112013 Annual Meeting, please follow these instructions:

If you are a stockholder of record on the April 12, 2013 record date, check the appropriate box on the proxy card (or indicate that you will attend when prompted by electronic voting means which you may access) indicating that you plan on attending the 2013 Annual Meeting, and please present at the meeting a valid picture identification, such as a driver’s license or passport.

If you are a stockholder whose shares are held in a brokerage account or by another nominee, please present at the meeting valid picture identification, such as a driver’s license or passport, as well as original proof of ownership of shares of Revlon, Inc. voting capital stock as of 5:00 p.m., Eastern Time, on the April 12, 2013 record date, in order to be admitted to the 2013 Annual Meeting. As noted, you will need to present original evidence of stock ownership, such as an original of a legal proxy from your bank or broker (“Requests for Admission” will not be accepted), your brokerage account statement, demonstrating that you held Revlon, Inc. voting capital stock in your account as of 5:00 p.m., Eastern Time, on the April 12, 2013 record date, or, if you did not already return it to your bank or broker, an original voting instruction form issued by your bank or broker, demonstrating that you held Revlon, Inc. voting capital stock in your account as of 5:00 p.m., Eastern Time, on the April 12, 2013 record date.

In order to ensure the safety and security of our meeting attendees, packages and bags may be inspected and may have to be checked and, in some cases, may not be permitted. We thank you in advance for your cooperation with these security measures.

| Q. | |

| Should I pre-register for the | |

| A. | In order to expedite the admission registration process required for you to enter the |

| Q. | Can I bring a guest to the |

| A. | Yes.If you plan to bring a guest to the |

v

| present valid picture identification to gain access to the |

| Q. | |

| Can I still attend the | |

| A. | Yes. Attending the |

v

| Q. | What shares are covered by my proxy card or electronic voting form? |

| A. | The shares covered by your proxy card or electronic voting form represent all of the shares of the Company’s voting capital stock that you own in the account referenced on the proxy card. Any shares that may be held for your account by the 401(k) Plan or another account will be represented on a separate proxy card and/or by a separate Control Number. |

| Q. | What does it mean if I get more than one proxy card? |

| A. | It means you have multiple accounts at our transfer agentand/or with banks or stockbrokers. Please vote all of your shares. |

vi

Annual Meeting of Stockholders

to be held on June 2, 20116, 2013

This Proxy Statement is being furnished on or about April 19, 201125, 2013 by and on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Revlon, Inc. (the “Company” or “Revlon”) in connection with the solicitation of proxies to be voted at the 20112013 Annual Meeting of Stockholders (the “2011“2013 Annual Meeting”) to be held at 10:00 a.m., Eastern Time, on Thursday, June 2, 2011,6, 2013, at Revlon’s Research Center at 2121 Route 27, Edison, NJ 08818, and at any adjournments thereof. The 20102012 Annual Report furnished with our Proxy Statement does not form any part of the material for the solicitation of proxies.

Pursuant to the rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are required to provide our stockholders with access to our proxy materials over the Internet, rather than only in paper form.Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Internet Notice”), rather than a printed copy of the proxy materials, to our stockholders of record as of April 8, 2011.12, 2013. You will not receive a printed copy of the proxy materials unless you already had a request for paper copies on file with our transfer agent or your broker. If you want to receive paper copies of the proxy materials, you must request them through one of the methods identified elsewhere in this Proxy Statement or in the Internet Notice.There is no charge imposed by the Company for requesting paper copies. Our proxy materials, including the Internet Notice, are being made available to stockholders entitled to vote at the 20112013 Annual Meeting on or about April 19, 2011.

At the 20112013 Annual Meeting, the Company’s stockholders will be asked to: (1) elect the following persons (all of whom currently are directors of the Company) as directors of the Company until the Company’s next annual stockholders’ meeting and until each such director’s successor is duly elected and has been qualified: Ronald O. Perelman, Alan S. Bernikow, Paul J. Bohan,Diana F. Cantor, Viet D. Dinh, Alan T. Ennis, Meyer Feldberg, David L. Kennedy, Cecelia Kurzman, Debra L. Lee, Tamara Mellon, Richard J. Santagati, Barry F. Schwartz and Kathi P. Seifert; (2) ratify the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2011;2013; and (3) provide their non-binding, advisory approval of the Company’s executive compensation, as disclosed pursuant to Item 402 ofRegulation S-K, including as disclosed in the “Compensation Discussion and Analysis,” compensation tables and accompanying narrative set forth in this Proxy Statement(“say-on-pay”); (4) consider and submit their non-binding, advisory vote on the future frequency of the“say-on-pay” vote on executive compensation(“say-on-frequency”); and (5) take such other action as may properly come before the 20112013 Annual Meeting or any adjournments thereof.

The Company’s principal executive offices are located at 237 Park Avenue, New York, NY 10017, and its main telephone number is(212) 527-4000.

In order to be admitted to the 20112013 Annual Meeting20112013 Annual Meeting in person, you should check the appropriate box on your proxy card (or indicate that you will attend when prompted by electronic voting means which you may access) indicating that you intend to attend in person and you will need to presentvalid picture identification, such as a driver’s license or passport, as well as originalproof of ownershipof shares of Revlon, Inc. Class A Common Stock, Class B Common Stock or Series A Preferred Stock as of 5:00 p.m., Eastern Time, on the April 8, 201112, 2013 record date. If your shares are held other than as a stockholder of record (such as beneficially through a brokerage, bank or other nominee account), you will need to present original documents (copies will not be accepted) to evidence your stock ownership as of 5:00 p.m., Eastern Time, on the April 8, 201112, 2013 record date, such as an original of a legal proxy from your bank or broker (“Requests for Admission” will not be accepted) or your brokerage account statement demonstrating that you held Revlon, Inc. voting capital stock in your account as of 5:00 p.m., Eastern Time, on the April 8, 201112, 2013 record date, or, if you did not already return it to your bank or broker, an original voting instruction form issued by your bank or broker, demonstrating that you held Revlon, Inc. voting capital stock in your account as of 5:00 p.m., Eastern Time, on the April 8, 201112, 2013 record date.

In order to ensure the safety and security of our annual meeting2013 Annual Meeting attendees, packages and bags may be inspected and may have to be checked and, in some cases, may not be permitted. We thank you in advance for your cooperation with these security measures.

All proxies properly submitted to the Company, unless such proxies are properly revoked before they are voted at the Additionally, pursuant to the Company’s By-laws, in order for business to be properly brought before the The submission of a signed or validly submitted electronic proxy will not affect a stockholder’s right to change 20112013 Annual Meeting, will be voted on all matters presented at the 20112013 Annual Meeting in accordance with the instructions given by the person executing (or electronically submitting) the proxy or, in the absence of instructions, will be voted (1) FORthe election to the Board of Directors of each of the 1112 nominees identified in this Proxy Statement (all of whom currently are directors of the Company);Statement; and (2) FORthe ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2011; (3) FORthe non-binding, advisory approval of the Company’s executive compensation, as disclosed pursuant to Item 402 ofRegulation S-K, including as disclosed in the “Compensation Discussion and Analysis,” compensation tables and accompanying narrative set forth in this Proxy Statement; and (4) for the non-binding, advisory recommendation of conducting future non-binding, advisory votes on executive compensation everyTHREE (3) YEARS(see2013 (see below for discussion of broker non-votes). The Company has no knowledge of any other matters to be brought before the meeting. The deadline for receipt by the Company of stockholder proposals for inclusion in the proxy materials for presentation at the 20112013 Annual Meeting was December 22, 2010.25, 2012. The Company did not receive any proposals required to be included in these proxy materials.20112013 Annual Meeting (other than stockholder proposals included in the proxy statement pursuant toRule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and business specified in this Proxy Statement), notice of such business must have been received by the Company between March 5, 20119, 2013 and April 4, 20118, 2013 (and not subsequently withdrawn) and such notice must have included, among other things: (i) information regarding the proposed business to be brought before such meeting; (ii) the identity of the stockholder proposing the business; and (iii) the class of the Company’s shares which are owned beneficially or of record by such stockholder. The Company did not receive notification of any such matters. If any other matters are properly presented before the 20112013 Annual Meeting for action, however, in the absence of other instructions, it is intended that the persons named by the Company and acting as proxies will vote in accordance with their discretion on such matters.theirhis, her or its vote, attendand/or vote in person at the 20112013 Annual Meeting. Stockholders who execute a proxy or validly submit an electronic vote may revoke it at any time before it is voted at the 20112013 Annual Meeting by: (i) filing a written revocation or written notice of change, as the case may be, which must be received by the Company’s Secretary at 237 Park Avenue, 14th Floor, New York, NY 10017, Attention: Michael T. Sheehan, before the original proxy is voted at the 20112013 Annual Meeting; (ii) executing and delivering a proxy bearing a later date, which must be received by the Company’s Secretary at 237 Park Avenue, 14th Floor, New York, NY 10017, Attention: Michael T. Sheehan, before the original proxy is voted at the 20112013 Annual Meeting; or (iii) attending the 20112013 Annual Meeting and voting in person. To revoke a proxy previously submitted electronically through the Internet or by telephone, you may simply vote again at a later date, using the sameeither of those electronic procedures, in which case the later submitted vote will be recorded and the earlier vote revoked.2

Only holders of record of shares of the Company’s Class A common stock, par value $0.01 per share (the “Class A Common Stock”), Class B common stock, par value $0.01 per share (the “Class B Common Stock” and, together with the Class A Common Stock, the “Common Stock”), and Series A Preferred Stock, par value $0.01 per share (the “Preferred Stock” and, together with the Common Stock, the “Voting Capital Stock”), at 5:00 p.m., Eastern Time, on April 8, 201112, 2013 (the “Record Date”) will be entitled to notice of and to vote at the 20112013 Annual Meeting or any adjournments thereof. On the Record Date, there were issued and outstanding: (i) 49,050,62849,231,798 shares of the Company’s Class A Common Stock, each of which is entitled to one vote, (ii) 3,125,000 shares of the Company’s Class B Common Stock, each of which is entitled to 10 votes, and (iii) 9,336,905 shares of the Company’s Preferred Stock, each of which is entitled to one vote. Of that Voting Capital Stock, Mr. Ronald O. Perelman, Chairman of the Board of Directors, directly and indirectly through MacAndrews & Forbes Holdings Inc., of which Mr. Perelman is the sole stockholder (together with certain of its affiliates (other than the Company or its subsidiaries), “MacAndrews & Forbes”), beneficially owned approximately 77% of the combined voting power of the outstanding shares of the Company’s Voting Capital Stock as of the Record Date that are entitled to vote at the 20112013 Annual Meeting.

The presence, in person or by duly submitted proxy, of the holders of a majority in total number of votes of the issued and outstanding shares of Voting Capital Stock entitled to vote at the 20112013 Annual Meeting is necessary to constitute a quorum in order to transact business at such meeting. Abstentions and, as there is at least one “routine” matter (under applicable NYSE rules) for consideration at the 20112013 Annual Meeting, “broker non-votes,” if any, will be included in the calculation of the number of shares present at the 20112013 Annual Meeting for the purposes of determining a quorum. “Broker non-votes” are shares held by a broker, trustee or nominee that are not voted because the broker, trustee or nominee does not have discretionary voting power on a particular proposal and does not receive voting instructions from the beneficial owner of the shares. Brokers will not be allowed to vote shares as to which they have not received voting instructions from the beneficial owner with respect to Proposal Nos.No. 1 (the election of directors), 3(“say-on-pay”) or 4(“say-on-frequency”). Accordingly, broker non-votes will not be counted as a vote for or against these proposals.this proposal. For shares as to which they have not received voting instructions from the beneficial owner, brokers will be able to vote on Proposal No. 2 (ratification of the Company’sAudit Committee’s selection of its independent registered public accounting firm for 2011)2013), as this is considered a “routine” matter under applicable NYSE rules for which brokers have discretionary voting power.

MacAndrews & Forbes has informed the Company that it will duly submit proxies (1)FORthe election to the Board of Directors of each of the 1112 nominees identified in this Proxy Statement (all of whom currently are directors of the Company);Statement; and (2) FORthe ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2011; (3) FORthe non-binding, advisory approval of the Company’s executive compensation; and (4) for recommending, on a non-binding, advisory basis, conducting future non-binding, advisory votes on executive compensation everyTHREE (3) YEARS.2013. Accordingly, there will be a quorum and the affirmative vote of MacAndrews & Forbes is sufficient, without the concurring vote of any of the Company’s other stockholders, to approve and adopt Proposal Nos. 1 2, 3 and 42 to be considered at the 20112013 Annual Meeting, as aforesaid.

If shares of Class A Common Stock are held as of the Record Date for the account of participants under the Revlon Employees’ Savings, Investment and Profit Sharing Plan (the “401(k) Plan”), the trustee for the 401(k) Plan will vote those shares pursuant to the instructions given by the 401(k) Plan participants on their respective voting instruction forms. If the trustee does not otherwise receive voting instructions for shares held on account of a 401(k) Plan participant, the trustee, in accordance with the 401(k) Plan trust agreement, will vote any such unvoted shares in the same proportion as it votes those shares allocated to 401(k) Plan participants’ accounts for which voting instructions were received by the trustee. 401(k) Plan participants must cast their votes in accordance with the instructions provided in the proxy materials so that they are received by 11:59 p.m. Eastern Time on May 26, 201124, 2013 to allow the trustee time to receive such voting instructions and vote on behalf of participants in the 401(k) Plan. Voting instructions received from 401(k) Plan participants after this deadline, under any method, will not be considered timely and will be voted by the trustee at the 20112013 Annual Meeting in the manner described in this paragraph above.

3

The accompanying form of proxy is being solicited on behalf of the Company’s Board of Directors. WeThe Company will bear all costs in connection with preparing, assembling and furnishing this Proxy Statement and related materials, including reimbursing banks, brokerage houses and other custodians, nominees, agents and fiduciaries for their reasonableout-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. The Company has hired Broadridge to assist in the distribution and on-line hosting of proxy materials (including the provision of electronic voting methods) for the 20112013 Annual Meeting. The estimated fee is approximately $10,500,$11,000, plusout-of-pocket expenses, such as postage.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” stockholder materials, such as proxy statements, information statements and annual reports. This means that only one copy of our Internet Notice or proxy materials, as the case may be, may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of our Internet Notice or the 20112013 proxy materials, as the case may be, to you if you write us at the following address: Revlon, Inc., Investor Relations Department, 237 Park Avenue, New York, NY 10017; or our proxy distributor at the following address: Broadridge, 51 Mercedes Way, Edgewood, NJ 11717. If you want to receive separate copies of the stockholder materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address. In the interest of reducing costs and promoting environmental responsibility, we encourage our stockholders to review electronic versions of our proxy materials, via the Internet.

The Company’s Board of Directors, pursuant to the Company’s By-laws, has fixed the number of directors at The Board of Directors has been informed that all of the nominees are willing to serve as directors, but if any of them should decline or be unable to serve, the Board of Directors may by resolution provide for a lesser number of directors or designate substitute nominees, in which event the individuals appointed as proxies will vote as directed as to the election of any such substitute nominee. The Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve.eleven (11),12, effective as of the date of the 20112013 Annual Meeting. The 1112 directors nominated for election by the Board of Directors, upon recommendation of the Board’s Nominating and Corporate Governance Committee, will be elected at the 20112013 Annual Meeting to serve until the Company’s next Annual Meetingannual stockholders’ meeting and until their successors are duly elected and shall have been qualified. All of the nominees currently are members of the Board of Directors.Directors (other than Ms. Cantor who is a new director nominee for the Company). All director nominees, if elected, are expected to serve until the next annual stockholders’ meeting. The Company has been advised that, for personal reasons and not as a result of any disagreement with the Company on any matter relating to its operations, policies or practices, each of Messrs. Paul Bohan and Richard Santagati will not stand for re-election at the 2013 Annual Meeting.

for which they have not received voting instructions from the beneficial owner. In light of the application of plurality voting to the electionVOTE REQUIRED AND BOARD OF DIRECTORS’ RECOMMENDATION1112 nominees identified in this Proxy Statement requires the affirmative vote of a plurality of the votes cast by the holders of shares of Voting Capital Stock present in person or represented by proxy at the 20112013 Annual Meeting and entitled to vote. With respect to Proposal No. 1, all proxies properly submitted to the Company, unless such proxies are revoked, will be voted in accordance with the instructions given by the person submitting such proxy or, in the absence of such instructions, will be votedFORthe election to the Board of Directors of each of the 1112 nominees identified in this Proxy Statement. Brokers do not have the ability to vote on “non-routine” matters, including the election of directors, as to shares4

The Board of Directors unanimously recommends that stockholders vote FOR the election to the Board of Directors of each of the 1112 nominees identified below.

The name, age (as of December 31, Mr. Perelman Mr. Bernikow (72) has been a Director of the Company and of Products Corporation since September 2003. Mr. Bernikow has served on the Board of Directors of Premier American Bank, N.A. since January 2010 as well as on the Board of Directors of such bank’s parent holding company, Bond Street Holdings, Inc., since October 2010. From 1998 until his retirement in May 2003, Mr. Bernikow served as the Deputy Chief Executive Officer of Deloitte & Touche LLP (“ Ms. Cantor (55), who is a new director nominee for the Company, is a Partner of Alternative Investment Management, LLC, an independent privately-held investment management firm (“Alternative Investment Management”), a position she has held since January 2010. In addition, Ms. Cantor is the co-founder and Managing Director of Hudson James Group LLC, a strategic advisory firm providing consulting services in the public and private sectors. Ms. Cantor also serves as the Chairman of the Board of Trustees of the Virginia Retirement System, for which she is a member of its Audit and Compliance Committee. Ms. Cantor served as a Managing Director of the New York Private Bank & Trust (the wealth management division of Emigrant Bank) from January 2008 through December 2009. From 1996 to January 2008, she served as the Founder and Executive Director of the Virginia College Savings Plan, an independent agency of the Commonwealth of Virginia. Ms. Cantor served from 1990 to 1997 as Vice President of Richmond Resources, Ltd. and from 1985 to 1990 as Vice President of Goldman, Sachs & Co. She previously was an associate at Kaye Scholer LLP from 1983 to 1985. Ms. Cantor has served on the boards of directors of the following public reporting companies within the last five (5) years: Media General, Inc. (“Media General”) (2005 — present), for which she also currently serves as chair of its audit committee; Domino’s Pizza, Inc. (“Domino’s Pizza”) (2005 — present), for which she also currently serves as chair of its audit committee; The Edelman Financial Group Inc. (2011 — 2012); and Universal Corporation (2012 — present), for which she also currently serves as a member of its audit committee. Mr. Dinh (44) has been a Director of the Company since June 2012. Mr. Dinh is the founding partner of Bancroft PLLC, a law and strategic consulting firm which he founded in 2003, and a tenured law professor at the Georgetown University Law Center, where he has taught since 1996. In addition, Mr. Dinh serves as the General Counsel and Corporate Secretary of Strayer Education, Inc., an education services holding company that owns Strayer University, which holding company he joined in 2010. From 2001 to 2003, Mr. Dinh served as Assistant Attorney General for Legal Policy at the U.S. Department of Justice. Mr. Dinh serves as a member of the Company’s Nominating and Corporate Governance Committee. Mr. Dinh has served on the Boards of Directors of the following public reporting companies within the last five years: News Corporation (2004 — present); M & F Worldwide (2007 — 2011 (note, M & F Worldwide ceased being a public reporting company under the Exchange Act in December 2011)); The Orchard, Inc. (2007 — 2010); and the Company (2012 — present). Mr. Ennis 2010)2012), principal occupation for the last five years, public company board service for the last five years, selected biographical information and period of service as a Director of the Company of each of the nominees for election as a director are set forth below.(67) (69)has been Chairman of the Board of Directors of the Company and of Revlon Consumer Products Corporation, the Company’s wholly-owned operating subsidiary (“Products Corporation”), since June 1998 and a Director of the Company and of Products Corporation since their respective formations in 1992. Mr. Perelman has been Chairman of the Board and Chief Executive Officer of MacAndrews & Forbes, Holdings Inc. (“MacAndrews & Forbes”), a diversified holding company, and certain of its affiliates since 1980. Mr. Perelman has served on the Boards of Directors of the following companies which were required to file reports under the Exchange Act or were registered investment companies under the Investment Company Act of 1940 (the “1940 Act”) (in either case, referred to herein as “public reporting companies”) within the last five years: the Company (1992 — present); Products Corporation (1992 — present); REV Holdings LLC (2002 — 2006); Scientific Games Corporation (“Scientific Games”) (2003 — present); Allied Security Holdings LLC (“Allied Security”) (2004 — 2008); and M&F & F Worldwide Corp. (1995 — present), a holding company that owns and operates various businesses (“M & F Worldwide”), for which Mr. Perelman has served as Chairman of the Board of Directors since 2007 and as a director since 1995 (note, M & F Worldwide ceased being a public reporting company under the Exchange Act in December 2011).M&F Worldwide”D&T”).(40)(42) has beenserved as the Company’s and Products Corporation’s President and Chief Executive Officer since May 2009. Mr. Ennis has served as a Director of the Company and of Products Corporation since March 2009. Mr. Ennis served as President, Revlon International from May 2008 to March 2009. Mr. Ennis served as the Company’s and Products Corporation’s Executive Vice President and Chief Financial Officer from November 2006 to May 2009, Treasurer from June 2008 to May 2009, and Corporate Controller and Chief Accounting Officer from September 2006 to March 2007. From March 2005 to September 2006, Mr. Ennis served as the Company’s Senior Vice President, Internal Audit. From 1997 through 2005, Mr. Ennis held several senior financial positions with Ingersoll-Rand Company Limited, a NYSE-listed company, where his duties included regional responsibility for Internal Audit in Europe and global responsibility for financial planning and analysis. Mr. Ennis began his career in 1991 with Arthur Andersen in Ireland. Mr. Ennis is a Chartered Accountant and member of the Institute of Chartered Accountants in Ireland. Mr. Ennis has served as a director of the Ireland — U.S. Council, a non-profit organization that seeks to build business links between America and Ireland, since November 2009. Mr. Ennis has a Bachelor of Commerce Degree from University College, Dublin, Ireland, and a Master of Business Administration Degree from New York University, New York, NY. Mr. Ennis has served on the Boards of Directors of the following public reporting companies which were required to file reports under the Exchange Act within the last five years: the Company (2009 — present) and Products Corporation (2009 — present).Mr. Kennedy (64) has been the Company’s and Products Corporation’s Vice Chairman since May 2009. Mr. Kennedy has served as a Director of the Company and of Products Corporation since September 2006. Mr. Kennedy has also served as Senior Executive Vice President of MacAndrews & Forbes since May 2009. Since April 2011, Mr. Kennedy has served as Vice Chairman and Chief Administrative Officer of Scientific Games (after serving as Vice Chairman since November 2010 and non-executive Vice Chairman since late 2009). Mr. Kennedy served as the Company’s and Products Corporation’s President and Chief Executive Officer from September 2006 to May 2009, and Executive Vice President, Chief Financial Officer and Treasurer from March 2006 to September 2006, and as the Company’s Executive Vice President and Products Corporation’s President, International from June 2002 until March 2006. From 1998 until 2001, Mr. Kennedy was Managing Director (CEO) and a member of the Board of Directors ofCoca-Cola Amatil Limited, a publicly-traded company headquartered in Sydney,5

Mr. Kennedy (66) has been the Company’s and Products Corporation’s Vice Chairman of the Board of Directors since May 2009. Mr. Kennedy has served as a Director of the Company and of Products Corporation since September 2006. Mr. Kennedy has also served as Senior Executive Vice President of MacAndrews & Forbes since May 2009. Mr. Kennedy served as Chief Administrative Officer of Scientific Games from April 2011 to March 2012. Mr. Kennedy has served as Vice Chairman of Scientific Games since October 2009. Mr. Kennedy served as the Company’s and Products Corporation’s President and Chief Executive Officer from September 2006 to May 2009, and Executive Vice President, Chief Financial Officer and Treasurer from March 2006 to September 2006, and as the Company’s Executive Vice President and Products Corporation’s President, International from June 2002 until March 2006. From 1998 until 2001, Mr. Kennedy was Managing Director (CEO) and a member of the Board of Directors of Coca-Cola Amatil Limited, a publicly-traded company headquartered in Sydney, Australia and listed on the Sydney Stock Exchange (“Coca-Cola Amatil”). From 1992 to 1997, Mr. Kennedy served as General Manager of the Coca-Cola USA Fountain Division, a unit of The Coca-Cola Company (“Coca-Cola”), which he joined in 1980. Mr. Kennedy has served on the Boards of Directors of the following public reporting companies within the last five years: the Company (2006 — present); Products Corporation (2006 — present); and Scientific Games (2009 — present).

Ms. Kurzman (43) has been a Director of the Company since February 2013. Ms. Kurzman serves as President of Nexus Management Group, Inc. (“Nexus Management”), a talent representation and consulting group which she founded in 2004. Prior to founding Nexus Management, Ms. Kurzman joined Epic/Sony Music in 1997 as Vice President of Worldwide Marketing and held positions of increasing responsibility there until 2004. From 1992 to 1997, Ms. Kurzman held positions of increasing responsibility at Arista Records, including serving as Director of Artist Development.

Ms. Lee (56) (58)has been a Director of the Company since January 2006. Ms. Lee is Chairman and Chief Executive Officer of BET Networks (“BET”), a division of Viacom Inc., a global media and entertainment company, that owns and operates Black Entertainment Television. Ms. Lee’s career atLee has held executive management positions of increasing responsibility with BET begansince joining that company in 1986 as Vice President and General Counsel. In 1992, she was named Executive Vice President of Legal Affairs and Publisher of BET’s magazine division, while continuing to serve as BET’s General Counsel. In 1995, Ms. Lee assumed responsibility for BET’s strategic business development and was named President and Chief Operating Officer in 1996.1986. Prior to joining BET, Ms. Lee was an attorney with the Washington, D.C.-based law firm of Steptoe & Johnson. Ms. Lee serves as a member of the Company’s Nominating and Corporate Governance Committee. Ms. Lee has served on the Boards of Directors of the following public reporting companies which were required to file reports under the Exchange Act within the last five years: Eastman Kodak Company (“Kodak”) (1999 — present)2011); WGL

6

Ms. Mellon (43) (45)has been a Director of the Company since August 2008. Ms. Mellon is the Chief Creative OfficerPresident of TMellon Enterprises LLC. In 1996, Ms. Mellon founded, and Founder ofthereafter until November 2011 served in a senior executive capacity with, J. Choo Limited (“Jimmy Choo”), a leading manufacturer and international retailer of glamorous,ready-to-wear women’s shoes and accessories based in London, England. Ms. Mellon has served in a senior executive capacity with Jimmy Choo since its inception in 1996.England, including serving most recently as Chief Creative Officer. Prior to that, Ms. Mellon served as accessories editor forBritish Voguemagazine, since 1990, and previously held positions atMirabellamagazine and Phyllis Walters Public Relations. Ms. Mellon also serves on the Board of Directors and on the Creative Advisory Board of The H Company Holdings, LLC, a privately held holding company which owns and manages the Halston fashion design company. Ms. Mellon has served on the BoardsBoard of Directors of the following companies which were required to file reports under the Exchange Actpublic reporting company within the last five years: the Company (2008 — present).

Mr. Schwartz (61)(63) has been a Director of the Company since November 2007 and a Director of Products Corporation since March 2004. Mr. Schwartz has served as Executive Vice Chairman and Chief Administrative Officer of MacAndrews & Forbes since October 2007, and as Chief Executive Officer of M&F Worldwide since January 2008. Prior to that, Mr. Schwartz was M&F Worldwide’s Acting Chief Executive Officer and General Counsel since September 2007 and its Executive Vice President and General Counsel since 1996.2007. Mr. Schwartz served as Senior Vice President of MacAndrews & Forbes from 1989 to 1993 and as Executive Vice President and General Counsel of MacAndrews & Forbes and various of its affiliates from 1993 to 2007. Mr. Schwartz is a memberserves as the Chairperson of the Board of Trustees of Kenyon College. In addition, Mr. Schwartz is also a member of the Board of Visitors of the Georgetown University Law Center. Mr. Schwartz serves as a member of the Company’s Compensation Committee. Mr. Schwartz has served on the Boards of Directors of the

following public reporting companies which were required to file reports under the Exchange Act within the last five years: REV Holdings LLC (2002 — 2006); Scientific Games (2003 — present); Products Corporation (2004 — present); Harland Clarke Holdings Corp. (2005 — present); Allied Security (2007 — 2008); the Company (2007 — present); and M&F & F Worldwide (2008 — present)present; note, M & F Worldwide ceased being a public reporting company under the Exchange Act in December 2011).

Ms. Seifert (61) (63)has been a Director of the Company since January 2006. Ms. Seifert has been ChairpersonPresident of Katapult, LLC, a business consulting company, since July 2004. Ms. Seifert served as Corporate Executive Vice President — Personal Care of Kimberly-Clark Corporation, a global health and hygiene company (“Kimberly-Clark”), from 1999 until her retirement in June 2004. Ms. Seifert joined Kimberly-Clark in 1978 and, prior to her retirement, served in several senior executive positions in connection with Kimberly-Clark’s domestic and international consumer products businesses. Prior to joining Kimberly-Clark, Ms. Seifert held management positions at The Procter & Gamble Company, Beatrice Foods, Inc. and Fort Howard Paper Company. Ms. Seifert serves as a member of each of the Company’s Audit Committee and its Compensation Committee. Ms. Seifert has served on the Boards of Directors of the following public reporting companies which were required to file reports under the Exchange Act within the last five years: Eli Lilly & Company (1995 — present), for which she also currently serves as a member of its audit committee (“Eli Lilly”); Albertson’s Inc. (2004 — 2006); Paperweight Development Corp. (2004 — present) (“Paperweight Development”); Appleton Papers Inc. (2004 — present) (“Appleton”); the Company (2006 — present); Lexmark International, Inc. (2006 — present) (“Lexmark”); and Supervalu Inc. (2006 — present), for which she also currently serves as a member of its audit committee2013) (“Supervalu”).

7

The Board of Directors currently has the following standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee (the “Governance Committee”). Each of these committees and their functions are described in further detail below.

The Company is a “controlled company” (i.e., one in which more than 50% of the voting power for the election of directors is held by an individual, a group or another company) within the meaning of the rules of the New York Stock Exchange (the “NYSE”). Accordingly, the Company is not required under the NYSE rules to have a majority of independent directors, a nominating and corporate governance committee or a compensation committee (each of which, under the NYSE’s rules, would otherwise be required to be comprised entirely of independent directors). While the Company is not required under NYSE rules to satisfy the above-listed NYSE corporate governance requirements due to its “controlled company” status, the Board has determined that more than a majority of its current directors (including Messrs. Bernikow, Bohan, Dinh, Feldberg and Santagati and Mses. Kurzman, Lee, Mellon and Seifert), as well as Ms. Cantor, a new director nominee, qualify as independent directors within the meaning of Section 303A.02 of the NYSE Listed Company Manual and under the Board Guidelines for Assessing Director Independence, which the Board adopted in accordance with Section 303A.02 of the NYSE Listed Company Manual. The Board Guidelines for Assessing Director Independence are available atwww.revloninc.com under the heading Investor Relations (Corporate Governance). Notwithstanding the fact that the Company qualifies for the “controlled company” exemption, the Company maintains the Governance Committee and the Compensation Committee. The Company maintains the Governance Committee (comprised of Messrs. Feldberg (Chairman), In October 2009, the Company SantagatiBohan, Dinh and BohanSantagati and Ms. Lee), and the Board of Directors has determined that all members of the Governance Committee qualify as independent directors within the meaning of Section 303A.02 of the NYSE Listed Company Manual and under the Board Guidelines for Assessing Director Independence. The Company also maintains the Compensation Committee (comprised of Messrs. Bernikow (Chairman), Santagati and Schwartz and Ms. Seifert), and the Board has determined that three of the four directors on the Compensation Committee (Mr. Bernikow, Mr. Santagati and Ms. Seifert) qualify as independent directors within the meaning of Section 303A.02 of the NYSE Listed Company Manual and under the Board Guidelines for Assessing Director Independence and also qualify as “non-employee directors” within the meaning of Section 16 of the Exchange Act and as “outside directors” under Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Code”).closedconsummated a voluntary exchange offer transaction, pursuant to which Revlon, Inc. issued to stockholders (other than MacAndrews & Forbes and certain of its affiliates) 9,336,905 shares of Preferred Stock (the “Exchange“2009 Exchange Offer”). In connection with the 2009 Exchange Offer, the Company entered into a Contribution and Stockholder Agreement, dated August 9, 2009, as amended, with MacAndrews & Forbes, pursuant to which the parties agreed, among other things, that, until October 8, 2013, the Company will continue to maintain a majority of independent directors on its Board of Directors, each of whom meets the “independence” criteria as set forth in Section 303A.02 of the NYSE Listed Company Manual (see “Certain Relationships and Related Transactions — Contribution and Stockholder Agreement”).

During 2010,2012, the Board of Directors held sixten meetings and acted six times by unanimous written consent; the Audit Committee held six meetings; the Compensation Committee held seven meetings;four meetings and acted once by unanimous written consent; and the Governance Committee held six meetings.8five meetings and acted once by unanimous written consent.

While the Board has not adopted a formal policy regarding directors’ attendance at the Company’s annual stockholders’ meeting, directors are invited to attend such meetings.meeting. One member of the Company’s Board of Directors attended the Company’s 20102012 Annual Stockholders’ Meeting.

The Company believes that its board leadership structure is appropriate given the specific circumstances of the Company, as its Board continues to function effectively and efficiently. Notwithstanding the fact that the Company is a “controlled” company, more than a majority of the Company’s Directors are independent under applicable SEC and NYSE rules. The Board has established audit, Set forth below is a summary of the nominatinggovernance and compensation committees, each operating under written charters, to assist the Board in its oversight functions, and in each case those committees are comprised of at least a majority of independent Directors (with each of the Board’s Audit Committee and Governance Committee being comprised entirely of independent directors and three of the four members of the Compensation Committee being independent directors). The qualifications and experience of nominees for board service and committee membership are reviewed annually by the Governance Committee. Nominees for board membership are then recommended by such committee for appointment by the Board. Respective committee chairmen lead each committee. The Company has not established a “lead director” role. At Board and committee meetings, the Chairman of the Board and the Chairman of each such committee, as applicable, presides for the purpose of conducting an orderly and efficient meeting. Independent directors or any other director may lead or initiate discussion, in the interest of promoting thorough consideration of any issue before the Board or any committee.of its committees. The Company has historically maintained separate positions of Chairman and Chief Executive Officer. Mr. Perelman, Chairman and Chief Executive Officer of MacAndrews & Forbes, has held the position of Chairman of the Company’s Board since June 1998 and Mr. Ennis has held the position of President and Chief Executive Officer of the Company since May 2009. The Chairman provides overall leadership to the Board in its oversight function, while the Chief Executive Officer provides leadership in respect to theday-to-day management and operation of the Company’s business. The Board and each committeeof its committees conduct annual self-assessments to review and monitor their respective continued effectiveness. As part of its 20102012 self-assessment exercise, the Board determined, among other things, that its size, composition and structure were appropriate. The Company believes thisthat its separation of the Chairman and Chief Executive Officer positions and its overall board leadership structure are appropriate.Company’s respective Directors’nominees’ experience, qualifications (including management experience, education and professional training) and background (including public company board experience and familiarity with the Company, including past service on the Company’s Board of Directors), which, among other factors, including as summarized in each Director’sindividual’s biographical information presented above in this Proxy Statement, and as set forth below, support their respective qualifications to continue to serve on the Company’s Board of Directors, or in the case of Ms. Cantor, to be elected to the Board of Directors. Without limiting the foregoing —

| • | Mr. | ||

| • | Ms. Cantor: Ms. Cantor’s senior executive experience in the areas of legal, investment and financial management (including currently serving as Partner of Alternative Investment Management and as Chairman of the Board of Trustees of the Virginia Retirement System), her accounting experience and financial expertise, and her significant public company directorship and committee experience (including at Media General, Domino’s Pizza and Universal Corporation) qualify her to serve on the Company’s Board. |

| • | Mr. |

General for Legal Policy for the U.S. Department of | |

| • | Mr. | ||

| • | Professor |

9

| Partners), his business experience (including serving as Senior Advisor at Morgan |

| • | Mr. | ||

| • | Ms. |

| • | Ms. Lee: Ms. Lee’s senior executive experience (including serving in various senior executive roles at BET, including currently serving as its Chairman and Chief Executive Officer), her legal experience (including having practiced as an attorney at the law firm of Steptoe & Johnson and then as General Counsel of BET), her public company board experience (including at | ||

| • | Ms. | ||

| • | Mr. | ||

| • | Mr. |

at | |

| • | ||

Ms. |

10

The Audit Committee is comprised of Messrs. Bernikow (Chairman), Bohan and Feldberg and Ms. Seifert, each of whom the Board of Directors has determined satisfies the NYSE’s and the SEC’s audit committee independence and financial experience requirements. Each of these directors served as a member of the Audit Committee during all of The Company has determined that Mr. Bernikow qualifies as an “audit committee financial expert,” under applicable SEC rules. In accordance with applicable NYSE listing standards, the Company’s Board of Directors has considered Mr. Bernikow’s simultaneous service on the audit committees of more than three public companies, namely the audit committees of the Company, Casual Male, Mack-Cali and the UBS Funds, and has determined that such service does not impair his ability to effectively serve on the Company’s Audit Committee as, among other things, Mr. Bernikow is retired and, accordingly, has a 20102012 and each of these directors remained a member of the Audit Committee as of the date of this Proxy Statement.more flexible schedule and more time to commit to service as an Audit Committee and Board member, including on a full-time basis, if necessary; he has significant professional accounting experience and expertise, which renders him highly qualified to effectively and efficiently serve on multiple audit committees; and the audit committees of the UBS Funds effectively function as a single, consolidated audit committee.

The Audit Committee operates under a comprehensive written charter, a printable and current copy of which is available atwww.revloninc.com under the heading, Investor Relations (Corporate Governance).

Pursuant to its charter, the Audit Committee is responsible for assisting the Board of Directors in fulfilling its oversight responsibilities with respect to, among other things, the integrity of the Company’s financial statements and disclosures; the Company’s compliance with legal and regulatory requirements; the appointment, compensation, retention and oversight of the Company’s independent auditors, as well as their qualifications, independence and performance; and the performance of the Company’s internal audit functions. The Audit Committee is also responsible for preparing the annual Audit Committee Report, which is required under SEC rules to be included in this Proxy Statement (see “— Audit“Audit Committee Report,” below).

The Audit Committee has established procedures for (a) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and (b) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. These complaint procedures are described in the Audit Committee’s charter, a printable and current copy of which is available atwww.revloninc.com under the heading, Investor Relations (Corporate Governance).

Management represented to the Audit Committee that the Company’s audited consolidated financial statements for the fiscal year ended December 31, The Audit Committee discussed with the Company’s independent registered public accounting firm those matters required to be discussed by Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T, including information concerning the scope and results of the audit and information relating to KPMG LLP’s20102012 were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed such audited consolidated financial statements with management and KPMG LLP, the Company’s independent registered public accounting firm.11

The Audit Committee has received the written disclosures and the letter from the Company’s independent registered public accounting firm, as required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with the Company’s independent registered public accounting firm that firm’s independence.

The Audit Committee also reviewed, among other things, the amount of fees paid to the independent registered public accounting firm for audit and permissible non-audit services (see “Audit Fees” in this Proxy Statement, below). The Audit Committee has satisfied itself that KPMG LLP’s provision of audit and non-audit services to the Company is compatible with KPMG LLP’s independence.

Based on the Audit Committee’s review of and discussions regarding the Company’s audited consolidated financial statements and the Company’s internal control over financial reporting with management, the Company’s internal auditors and the independent registered public accounting firm and the other reviews and discussions with the independent registered public accounting firm referred to in the preceding paragraph, subject to the limitations on the Audit Committee’s roles and responsibilities described above and in the Audit Committee charter, the Audit Committee recommended to the Board of Directors that the Company’s audited consolidated financial statements be included in the Company’s Annual Report onForm 10-K for the fiscal year ended December 31, 20102012 for filing with the SEC.

Respectfully submitted,

Audit Committee

Alan S. Bernikow, Chairman

Paul J. Bohan

Meyer Feldberg

Kathi P. Seifert

The Compensation Committee is comprised of Messrs. Bernikow (Chairman), Santagati and Schwartz and Ms. Seifert. Each of these directors served as a member of the Compensation Committee during all of 2010, other than Mr. Santagati who was appointed to such committee in February 2010,2012 and each of these directors remained a member of the Compensation Committee as of the date of this Proxy Statement.

The Compensation Committee operates under a comprehensive written charter, a printable and current copy of which is available atwww.revloninc.com under the heading, Investor Relations (Corporate Governance).

Pursuant to its charter, the Compensation Committee reviews and approves corporate goals and objectives relevant to the compensation of the Company’s Chief Executive Officer (the “CEO”), evaluates the CEO’s performance in light of those goals and objectives and determines, either as a committee or together with the Board of Directors, the CEO’s compensation level based on such evaluation. The Compensation Committee also reviews and approves compensation and incentive arrangements for the Company’s executive officers and such other employees of the Company as the Compensation Committee may determine to be necessary or desirable from time to time. The Compensation Committee also reviews and approves awards pursuant to the Third Amended and Restated Revlon, Inc. Stock Plan (the “Stock Plan”) and the Revlon Executive Incentive Compensation Plan (the12

The Compensation Committee is also responsible for reviewing and discussing with the Company’s Chief Executive Officer and Chief Administrative Officerappropriate officers the Compensation Discussion and Analysis required by the SEC’s rules and, based on such review and discussion, (i) determining whether to recommend to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s annual report onForm 10-K or in the annual proxy statement (and incorporated by reference into the annual report onForm 10-K) and (ii) producing the annual Compensation Committee Report and approving its inclusion in the Company’s annual report onForm 10-K or in the annual proxy statement.

Pursuant to the terms of the Incentive Compensation Plan, the Compensation Committee may delegate to an administrator (who must be an employee or officer of the Company) the power and authority to administer the Incentive Compensation Plan for the Company’s employees, other than its Chief Executive Officer and certain other officers who constitute “covered employees” as defined in Treasury Regulation § 1.162-27(c)§1.162-27(c)(2) (“Section 162(m) Officers”). Section 157(c) of the Delaware General Corporation Law (the “DGCL”) provides that the Company’s Board of Directors (or the Compensation Committee acting on behalf of the Board) may delegate authority to any officer of the Company to designate grantees of equity awards under the Stock Plan other than himself or herself and to determine the number of such equity awards to be issued. The Compensation Committee did not delegate any such authority for 2010.

For a discussion of the role of the Company’s executive officers and compensation consultants in recommending the amount or form of executive and director compensation, and the consideration of any possible conflicts of interest with the Compensation Committee’s outside compensation advisor, see “— Compensation Discussion and Analysis — Role of the Compensation Committee.”

The Compensation Committee does not have any interlocks or insider participation requiring disclosure under the SEC’s executive compensation rules.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis set forth below in this Proxy Statement with the Company’s appropriate officers. Based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement, as well as in the Company’s Annual Report onForm 10-K for the fiscal year ended December 31, Respectfully submitted, Compensation Committee Alan S. Bernikow, Chairman Richard J. Santagati Barry F. Schwartz Kathi P. Seifert2010,2012, including by incorporation by reference to this 20112013 Proxy Statement.

The Governance Committee is comprised of Messrs. Feldberg (Chairman), SantagatiBohan, Dinh and BohanSantagati and Ms. Lee. Each of these Directors served as a member of the Governance Committee during all of 2010, other2012 (other than13

The Governance Committee operates under a comprehensive written charter, a printable and current copy of which is available atwww.revloninc.com under the heading, Investor Relations (Corporate Governance).

Pursuant to its charter, the functions of the Governance Committee include, among other things: identifying individuals qualified to become Board members; selecting or recommending to the Board proposed nominees for Board membership; recommending directors to the Board to serve on the Board’s standing committees; overseeing the evaluation of the Board’s performance; evaluating the CEO’s and senior management’s performance; overseeing the Revlon, Inc. Related Party Transaction Policy; overseeing the Company’s processes for succession planning for the CEO and other senior management positions; and periodically reviewing the Board’s Corporate Governance Guidelines and Board Guidelines for Assessing Director Independence and recommending changes, if any, to the Board.

The Governance Committee identifies individuals qualified to become members of the Board when any vacancy occurs by reason of disqualification, resignation, retirement, death or an increase in the size of the Board, and selects or recommends that the Board select director nominees for each annual meeting of stockholders and director nominees to fill vacancies on the Board that may occur between annual meetings of stockholders. In evaluating director nominees, the Governance Committee is guided by, among other things, the principles for Board membership expressed in the Company’s Corporate Governance Guidelines, which are available atwww.revloninc.com under the heading, Investor Relations (Corporate Governance). The Governance Committee, in identifying and considering candidates for nomination to the Board, considers, in addition to the requirements set out in the Company’s Corporate Governance Guidelines and the Governance Committee’s charter, the quality of the candidate’s experience, the Company’s needs and the range of talent and experience represented on the Board. In its assessment of each potential candidate, the Governance Committee will consider the nominee’s reputation, judgment, accomplishments in present and prior positions, independence, knowledge and experience that may be relevant to the Company, and such other factors as the Governance Committee determines to be pertinent in light of the Board’s needs over time, including, without limitation, education, diversity, race, gender and other individual qualities and attributes that are expected to contribute to the Board having an appropriate mix of viewpoints. The Governance Committee identifies potential nominees from various sources, such as officers, directors and stockholders, and from time to time retains the services of third party consultants to assist it in identifying and evaluating director nominees.

The Governance Committee will also consider director candidates recommended by stockholders. The process the Governance Committee follows to evaluate candidates submitted by stockholders does not differ from the process it follows for evaluating other director nominees. The Governance Committee may also take into consideration the number of shares held by the recommending stockholder, the length of time that such shares have been held and the number of candidates submitted by each stockholder or group of stockholders over the course of time. Stockholders desiring to submit director candidates must submit their recommendation in writing (certified mail — return receipt requested) to the Company’s Secretary, at Revlon, Inc., 237 Park Avenue, 14th Floor, New York, NY 10017, attention: Michael T. Sheehan. The Governance Committee will accept recommendations for director candidates throughout the year; however, in order for a recommended director candidate to be considered by the Governance Committee for nomination to stand for election at an upcoming annual meeting of stockholders, the recommendation must be received by the Company, as set forth above, not less than 120 days prior to the anniversary date of the date of the14

the stockholder’s name and address, evidence of such stockholder’s ownership of the Company’s Voting Capital Stock, including the number of shares owned and the length of time of ownership, and a statement as to the number of director candidates such stockholder has submitted to the Governance Committee during the period that such stockholder has owned shares of the Company’s Voting Capital Stock, including the names of any candidates previously submitted by such stockholder;

the name of the candidate;

the candidate’s resume or a listing of his or her qualifications to be a director of the Company;

any other information regarding the candidate that would be required to be disclosed in a proxy statement filed with the SEC if the candidate were nominated for election to the Board; and

the candidate’s consent to be named as a director, if selected by the Governance Committee and nominated by the Board.

The Board of Directors has established a process to receive communications from stockholders and other interested parties. Any stockholder or other interested party desiring to communicate with the Board or individual directors (including, without limitation, the non-management directors) regarding the Company may contact either the Board or such director by sending such communication to the attention of the Board or such director, in each case in care of the Company’s Secretary, who is responsible to ensure that all such communications are promptly provided to the Board or such director. Any such communication may be sent by: (i) emailing it to Michael T. Sheehan, Senior Vice President, Deputy General Counsel and Secretary, atmichael.sheehan@revlon.com; or (ii) mailing it to Revlon, Inc., 237 Park Avenue, 14th Floor, New York, NY, 10017, attention: Michael T. Sheehan. Communications that consist of stockholder proposals must instead follow the procedures set forth under “General Rules Applicable to Stockholder Proposals” in this Proxy Statement, below, and, in the case of recommendations of director candidates, “Nominating and Corporate Governance Committee — Stockholder Process for Submitting Director Nominees,” in this Proxy Statement, above. Communications